UK Government Bonds - A gift for the active manager?

Related links

No related links

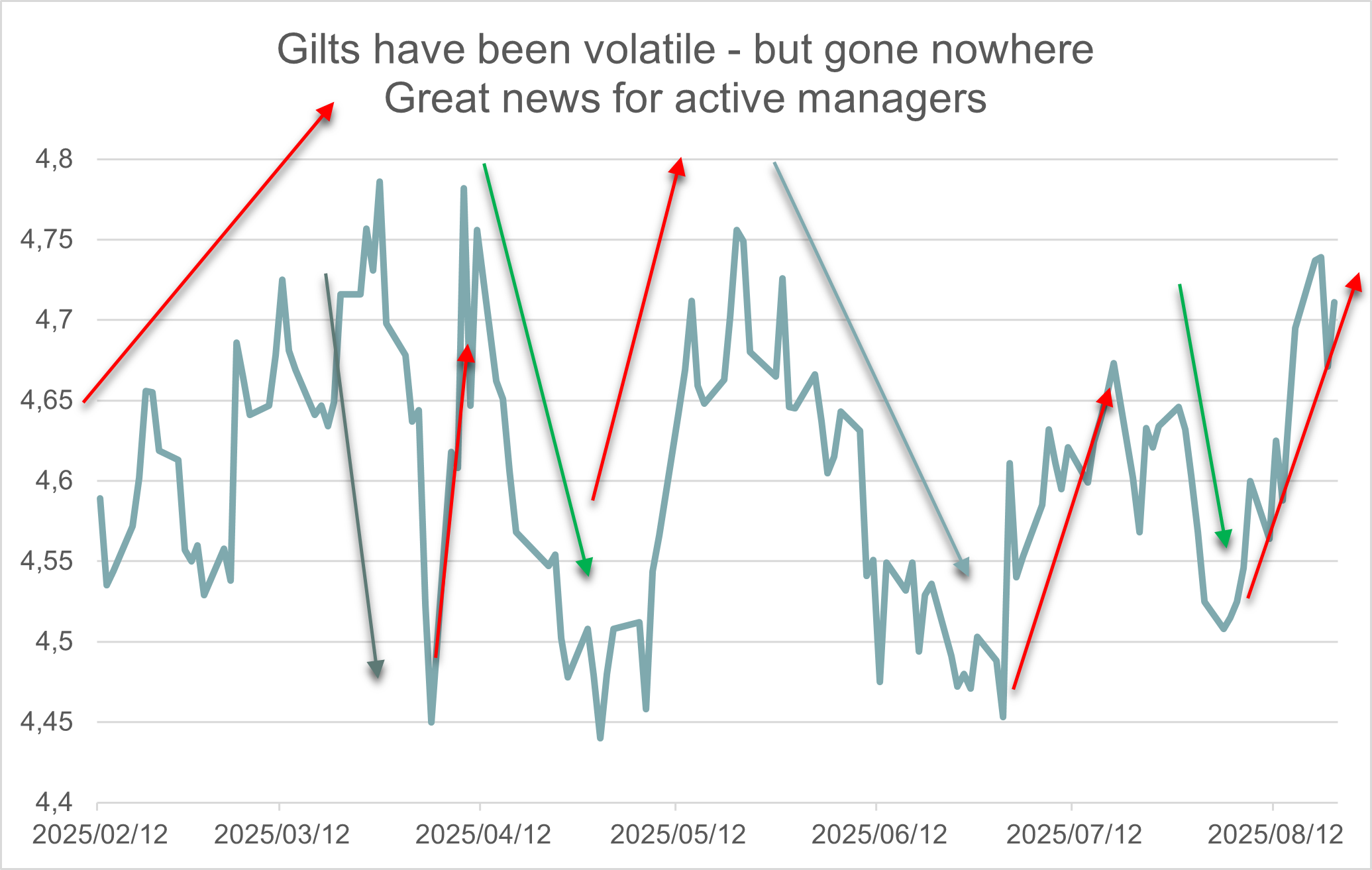

The current 10 year UK Gilt was issued in February 2025

- Since launch, yields have risen slightly – from around 4.6% to 4.7%

- A passive fund buying at launch would have gained around 1% since, the income offsetting a small degree of capital loss

- Since February, the bond yield has risen or fallen by more than 20 basis points NINE times

- 20 basis points in yield is about 2% in price

An ACTIVE manager has had at least 9 opportunities to make DOUBLE the return of a passive alternative.

This article is of a general nature and intended for information purposes only, it is not intended for distribution to any person or entity who is a citizen or resident of any country or other jurisdiction where such distribution, publication or use would be contrary to law or regulation. Whilst all reasonable steps have been taken to ensure that this article is accurate and current at the time of publication, we shall accept no responsibility or liability for any inaccuracies, errors or omissions relating to the information and topics covered in this article.

The opinions expressed within the article are considered to be correct and informed at the time of writing, but may be subject to change or amendment at the discretion of the Investment Manager without notice.

Nedgroup Investment (IOM) Limited (reg no 57917C), is licensed by the Isle of Man Financial Services Authority.

Nedgroup Investments (UK) Limited is regulated by the Financial Conduct Authority.