GLOBAL MULTI-MANAGEMENT

Nedgroup Investments Multi-Manager is a dedicated asset management division within Nedgroup Investments. Collectively the team manages in excess of R25bn in assets. The multi-management team consists of investment professionals based in Cape Town and London who specialise in fund manager research and asset allocation. All investment decisions are based on careful, informed and fundamentally-driven research conducted by a well-resourced investment team. The selected fund managers are carefully appointed based on proven, consistent track records. We generally partner with these fund managers over the long term; however, we do have the flexibility to make changes where necessary.

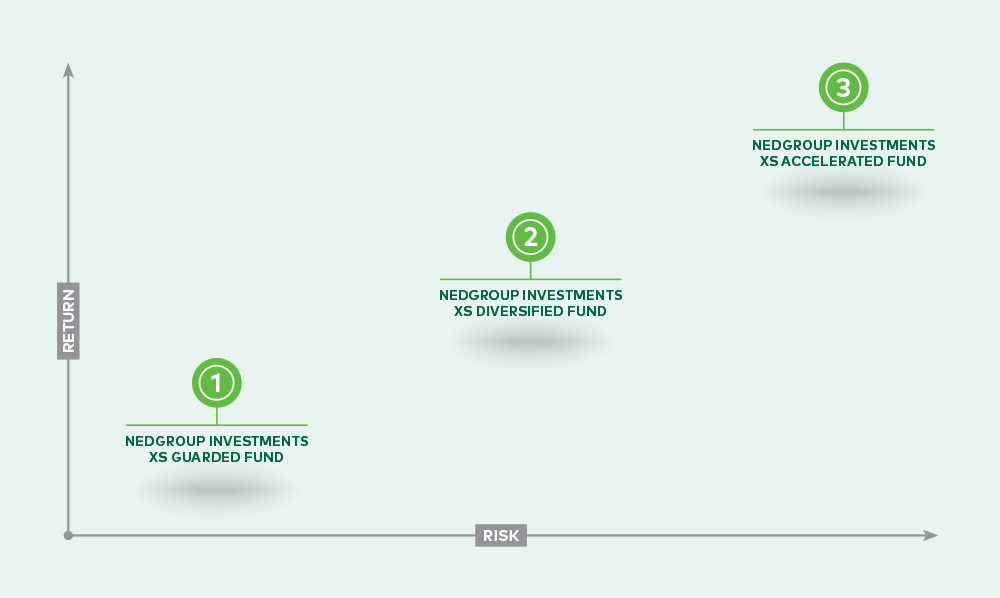

The Nedgroup Investments XS Fund of Fund range consists of three actively managed funds that are invested in a diversified range of local and foreign portfolios. These solutions are invested across a blend of underlying fund managers.