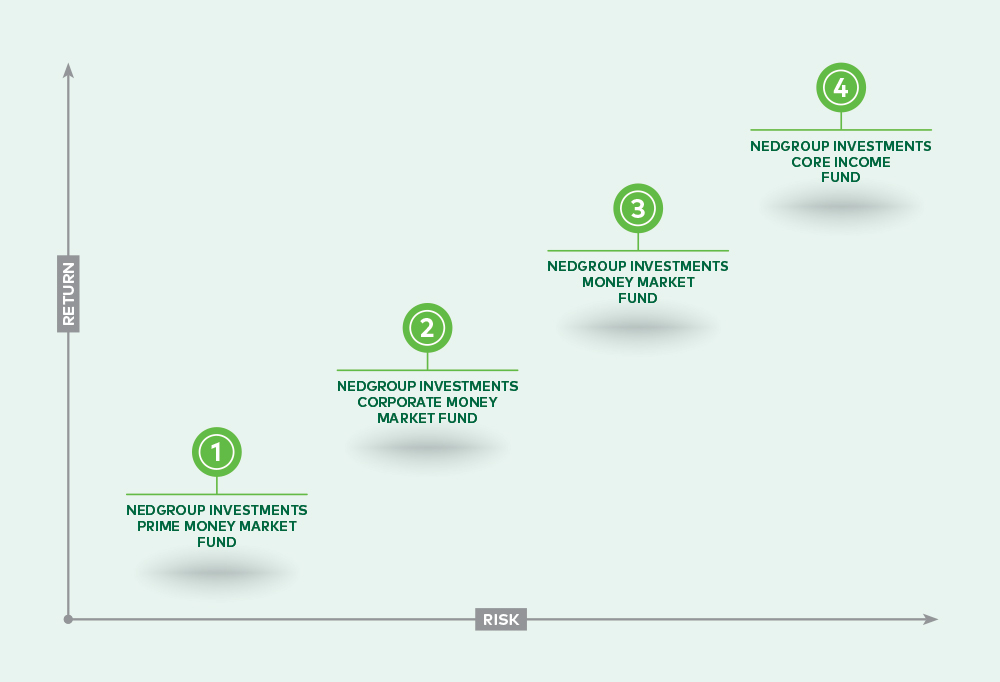

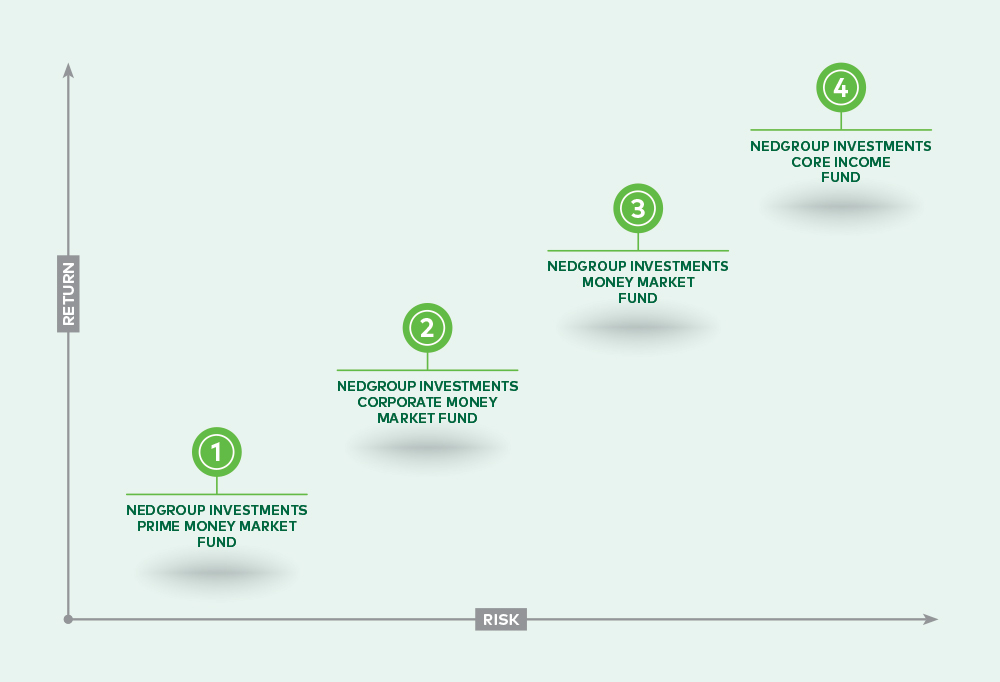

Nedgroup Investments Cash Solutions is one of the leading cash solutions businesses on the continent providing innovative and tailor-made solutions for yield and liquidity with capital preservation, to a wide range of clients, ranging from institutional retirement funds and corporate treasurers to public entities

Nedgroup Investments Cash Solutions provides clients with attractive yields with the liquidity benefits of traditional call accounts, and without the constraints of fixed deposits. This means that instead of lying idle, your cash is working for you to provide extra yield that can make all the difference to business efficiency.

We offer access to the lowest risk unit trusts in the industry but with the benefits of positive returns and same day, or next day access to funds. This is the perfect parking space for surplus cash within corporate or retirement fund structures. All of Nedgroup Investments Cash Solutions funds are independently rated by Global Credit Ratings.

The fund aims to preserve capital and provide an attractive alternative to saving deposit accounts. In addition, it invests in money market instruments which are issued by large international corporates. The fund should provide diversification across counterparties. The funds should offer daily liquidity and a yield higher than money market funds. The benchmark is the STeFI Call Deposit.

This fund has stricter credit and exposure requirements than those stipulated by the Association for Savings and Investment South Africa. The fund is a money market fund that invests only in the highest quality paper available with a maximum exposure to any counter-party of 25%. This fund is compliant with Regulation 28 of the Pension Funds Act and Regulation 29 and 30 of the Medical Schemes Act.

The Money Market Fund is suitable for investors who require high levels of income and capital preservation and provides an attractive alternative to current and savings accounts. It may be used to diversify away from equity assets or as a short-term investment for capital. The portfolio typically displays a very low level of volatility. The benchmark is the STeFI Call Deposit.

The Core Income Fund is best suited to client cash that is more stable or ‘core’ and which the investor does not expect to draw over the short-term. The fund offers higher yields than money market funds and access is 24 hours. This fund is compliant with Regulation 28 of the Pension Funds Act.