Fund news

Why are bank spreads low despite heighted risks?

Related links

No related links

Of the two funding options available to banks, namely retail and wholesale, the Big Four banks in South Africa have raised considerable proportions of their funding base from the wholesale market. The majority of the Big Four SA bank’s wholesale funding consists of term funding and NCDs. NCDs are the most common funding instrument used by the banks to raise funds that could be used for lending and hence we analyse it alongside term debt issuance. Banks can raise funding from NCDs quickly and efficiently and that is what makes it a great liquidity indicator.

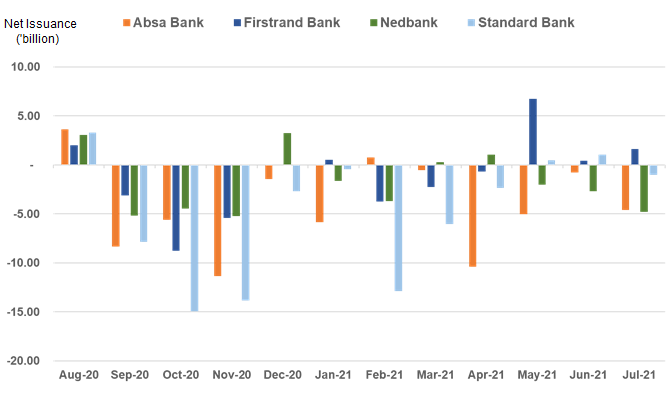

Figure 1: Big 4 Bank Net NCD Issuance over the past 12 months

Source: Taquanta Asset Managers, STRATE

Banks balance sheets are contracting because of low credit demand and the concerns around the SA economy. The low and often negative issuance (if we take maturities into account) is fuelling the demand and supply imbalance between depositors and borrowers, and suppressing bank credit spreads to artificially low levels. This phenomenon started playing out in the second half of 2020, and it continues. The chart above highlights the supply shortage currently in bank NCDs. The demand-and-supply imbalance has much wider implications in the fixed income market. That is because the Big Four bank NCDs are used by the market as a proxy to price other types of fixed income debt in the market. Pricing is always relative to a Big Four bank NCD which is regarded as the most liquid instrument in the market.

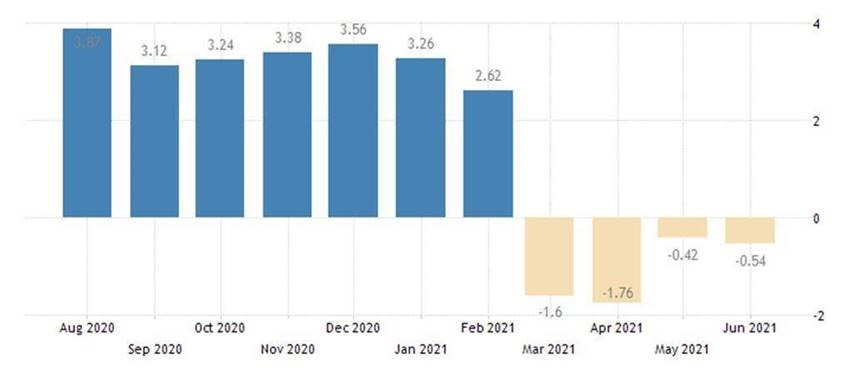

Private Sector Credit Extension (PSCE) numbers echo the above sentiment. PSCE surprised the market in June with its fourth consecutive contraction. PSCE contracted by 0.54% YoY in June, which was in stark contrast with the market’s consensus expectation of a 0.4% YoY gain, and historic trends! The persistent general weakness in credit growth (which remains negative on the corporate side) and particularly the slowdown in household credit momentum can be seen in Figure 2 below.

Figure 2: Private Sector Credit Extension (PSCE) – YoY growth

Source: tradingeconomics.com / South African Reserve Bank

This validates our current view of a slow and gradual interest rate hiking cycle. Bank balance sheets are largely stagnating, thereby limiting the necessity to issue paper. This in turn means that the scarcity of bank paper will continue to keep spreads tight.

Despite the rise in business confidence in the second quarter of 2021, SA businesses have remained reluctant to take on more credit as uncertainties around the economic outlook remain due to the third wave of coronavirus infections and additional lockdown restrictions.

Only once PSCE picks up in a meaningful way, will we start to see a gradual rise in bank spreads. The impact of the recent riots has only served to reduce business confidence, just as it was beginning to return, further delaying demand for credit and highlighting the extensive intangible damage the attempted insurrection has caused. Investors are not being adequately rewarded for longer-term bank paper. The term premium is not sufficient on a risk-adjusted basis. The lack of issuance is distorting credit spreads.

Nedgroup Investments Cash Solutions and Taquanta Asset Managers