It’s not just a tax-free investment. It’s a milestone worth celebrating.

Related links

Tax-Free Investments It’s not just a tax-free investment. It’s a milestone worth celebrating.Article highlights

- Tax‑free investing in South Africa has evolved into a long‑term wealth‑building cornerstone.

- The real value of TFIs comes from time, consistency and discipline, not complexity.

- Significant tax‑free growth potential still remains for many investors.

As South Africa moves beyond its first decade of tax‑free investing, the real story is no longer about whether people understand Tax‑Free Investment (TFI) accounts – it’s about how they are using them. Insights from the 2025 Nedgroup Investments Tax‑Free Investments Survey show that tax‑free investing has matured into a core part of long‑term financial planning, particularly among younger investors. Nearly eight in ten respondents already have a TFI in place, reflecting strong adoption and a growing culture of disciplined saving.

What stands out most is the long‑term mindset behind these investments. More than 70% of investors surveyed are saving with a 10‑year or longer horizon in mind, with no respondents using a TFI for short‑term goals. Across all age groups, the primary objective is supplementing retirement income, while younger investors are also using TFIs to fund milestones and children’s education. Meanwhile, older investors increasingly see TFIs as a tool for legacy planning and intergenerational wealth.

This long‑term focus is where tax‑free investing really shines. When investors are consistent and patient, the power of compounding can deliver meaningful outcomes over time, all without having to worry about paying tax on interest, dividends or capital gains along the way.

The power of compounding in action

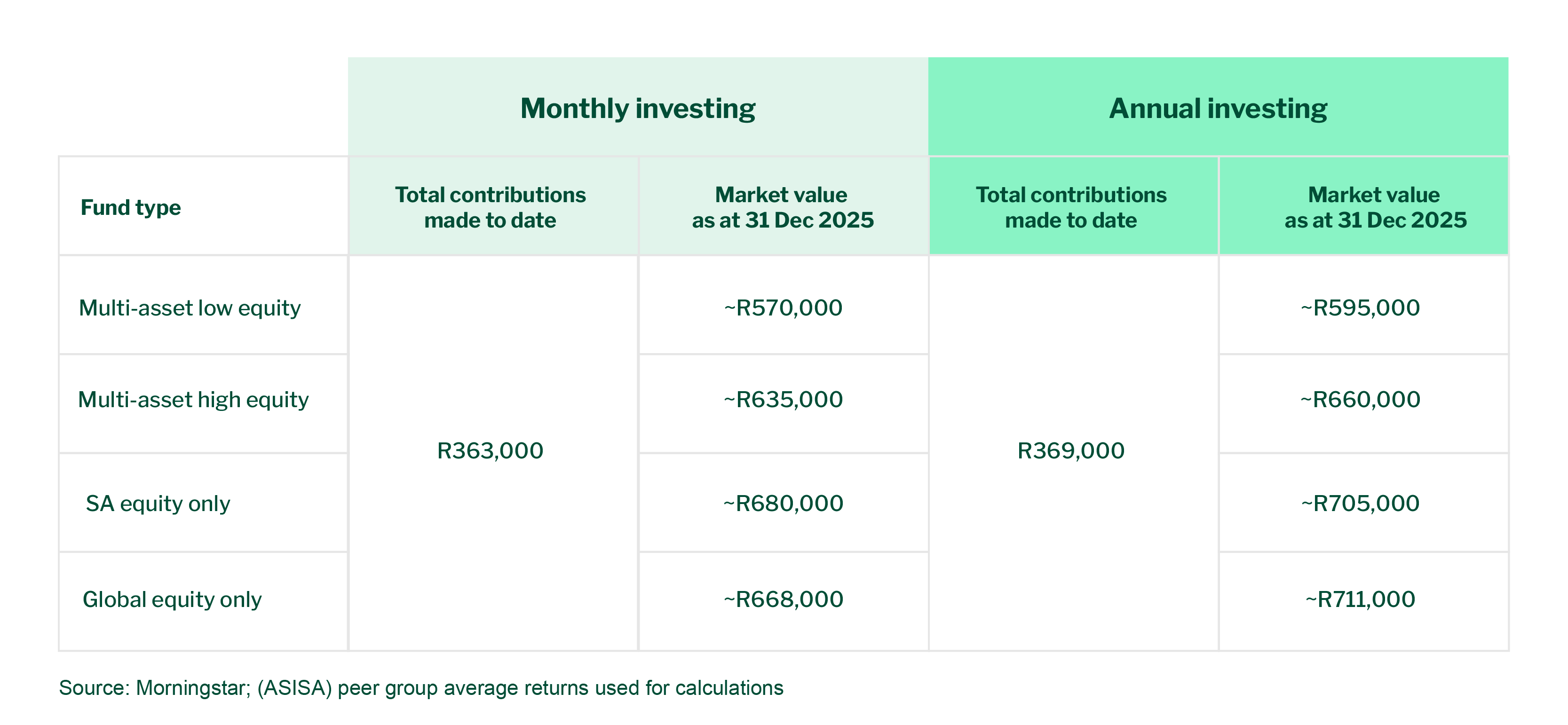

Sometimes the most powerful investing decision is also the simplest one: start early, contribute what you can, and give your investment the time it needs to grow.Investors who began contributing to their TFIs in 2015, and simply stayed invested, are now sitting with balances that few would have expected at the outset. As at 31 December 2025, an investor who consistently used their tax‑free allowance from the start has built a portfolio worth between R570,000 and R710,000, depending on the asset class and contribution approach.

Here's what a decade of consistency looks like

10 years of Tax-Free Investing: Comparing tax-free growth by asset class

What stands out from these results is how little complexity was required to achieve them. Investors did not need to switch funds, time markets, or make tactical changes along the way. Whether contributions were made monthly or annually, the differences in outcomes were modest, and driven primarily by asset allocation rather than contribution timing.

In fact, the most important ingredient behind the growth shown here was simply time. The longer investors stayed invested, the more compounding was allowed to do the heavy lifting.

Crucially, this principle applies at all contribution levels. Tax‑free investing is not only effective for those who are able to maximise their allowance from day one. Even investing from as little as R250 – R500 per month, or increasing contributions gradually over time, allows investors to benefit from the same compounding effect. The habit of consistent saving matters just as much as the rand amount invested.

What Nedgroup Investments investors are achieving

This long‑term approach is clearly reflected in the behaviour of Nedgroup Investments’ clients. As at 31 December 2025, Nedgroup Investments administers R1.3 billion in Tax‑Free Investment assets on behalf of just under 10,000 investors. Many investors continue to top up their investments year after year, which allows compounding to work over increasingly long time horizons.

How much tax‑free investing potential do you still have?

Despite the progress some investors have made, many still have significant unused lifetime allowances available.

Depending on your contribution style, this is your remaining tax-free investing potential at the time of writing this article:

- If you have been maximising monthly contributions, you still have up to R134,000 of your lifetime limit available

- If you have followed an annual contribution approach and already used this tax year’s full R36,000 allowance, you still have around R131,000 left before reaching the R500,000 lifetime limit

This remaining capacity represents a valuable opportunity to continue building tax‑free wealth, particularly for long‑term goals such as supplementing retirement income, education funding, or legacy planning.

A quick refresher: How Tax‑Free Investment accounts work

For those new to tax‑free investing, a Tax‑Free Investment account allows South African investors to grow their savings free from income tax, dividends tax, and capital gains tax, provided they stay within the prescribed limits. Investors may contribute up to R36,000 per year and R500,000 over their lifetime. While withdrawals are allowed, they cannot be replaced, which makes TFIs best suited to long‑term saving rather than excessive short‑term access.

TFI accounts can also be opened for children, enabling families to harness the power of compounding from an early age and establish strong financial habits across generations.

Looking ahead

Having moved beyond the first decade, tax‑free investing in South Africa has matured into far more than a simple tax benefit. It has become a powerful behavioural tool - one that rewards consistency, supports long‑term financial security, and creates flexibility across life stages. Whether you are already well on your way or just starting with what you can afford, the years ahead still offer significant potential for disciplined, tax‑free growth.

%20-%20Website%20Images%20(1400x900)Adjusted.jpg)