Bravata Worldwide Flexible Fund

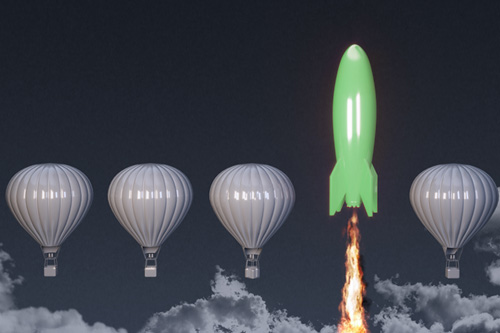

The Nedgroup Investments Bravata Worldwide Flexible Fund is a flexible multi-asset fund that focuses on long-term investing and capital preservation. This fund is unconstrained and follows a fully flexible strategy, which provides investors with access to the fund manager’s best investment views across all asset classes, locally and globally.

Reasons to invest

Asset allocation and security selection are conducted independent of traditional benchmarks, providing returns less correlated to the market | The fund is unrestricted in terms of asset class and geographical location, giving complete flexibility to capitalise on the best performing assets based on market conditions | Currency diversification reduces the impact of local currency fluctuations on the portfolio’s value and can provide a hedge against inflation and geopolitical risk

Specific fund risks

Equity and property investments are volatile by nature and subject to potential capital loss | Fixed income instruments, including corporate and government bonds, may experience capital loss in the event that an issuer defaults on their interest or principal payments | The portfolio may be subject to currency fluctuations due to its international exposure

Suitable for

The Bravata Worldwide Flexible Fund is suitable for investors looking for balanced exposure to both domestic and offshore assets, and whose primary goal is maximum capital appreciation. Investors who are comfortable experiencing shorter-term volatility due to the portfolios risk asset and offshore exposure may also invest in this fund