The Stable Fund Series: article 3 of 5: Performance vs inflation +4%

Related links

No related links

In the previous article, we discussed the investment philosophy of the Nedgroup Investments Stable Fund and that the primary objective of the fund is to produce inflation beating returns while avoiding capital losses. In this context, let’s examine market conditions over the past three years.

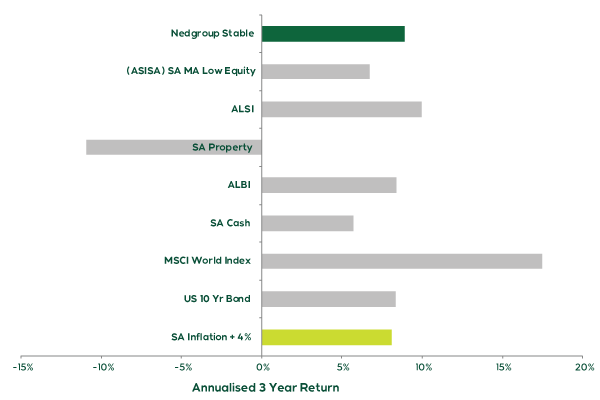

The chart below shows returns of the Nedgroup Investments Stable Fund relative to the category average; various market indices; and inflation + 4% over the past three years:

Source: Nedgroup Investments, Morningstar, data to 31st May 2021

As can be seen here, the only way South African investors could have beaten inflation + 4% over this period was to have your money invested in risky asset classes (SA cash did not produce high enough returns) and even that was not a guaranteed bet (like SA Property which had a really tough time especially since March last year). Over the past three years, the unbelievable increase in share prices of some of the large global tech stocks has driven the MSCI World Index ever higher resulting in fantastic returns despite the economic hardships that many people around the world have had to face. Locally, the past few years have been quite turbulent, characterised by high levels of political risk and economic uncertainty.

This insight into the shorter-term performance is useful – but again we must be cognisant that it is the longer-term performance that we must continue to focus on for our investors. How does one consider the long-term picture with an investment return target of inflation + 4% p.a.?

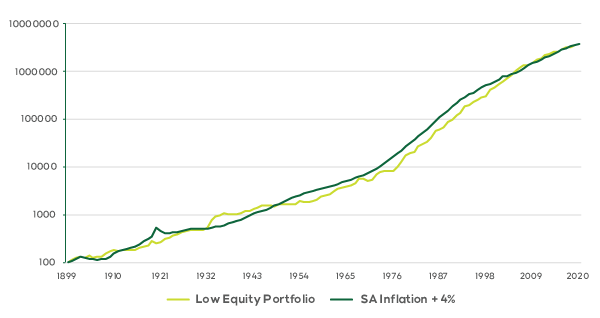

What we’ve done next is to take the return of a generic low equity fund (maximum 40% equity exposure) made up of only three SA asset classes: equities, bonds and cash. The strategic asset allocation has been fixed at 37% in equities with the rest of the fund equally split between bonds and cash. We’ve then compared these returns to SA inflation + 4% both on a cumulative and rolling three-year basis and calculated the relative performance which is then displayed in the two charts below.

There are some interesting points worth mentioning. Firstly, when measured all the way back to 1900 both the performance of inflation + 4% and the generic low equity fund was 9.1% p.a. However, the calculated volatility was 6.5% and 10.2% respectively, which highlights the fundamental issue that we’re forced to contend with, ie. having to beat a relatively less volatile benchmark by using higher volatility asset classes:

Source: Nedgroup Investments, Firer Database, Morningstar

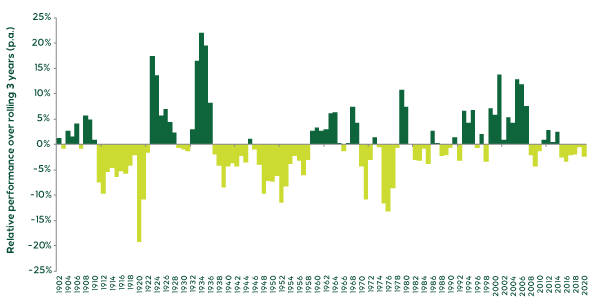

The reality is that this generic low equity fund will over- or under-shoot the inflation + 4% p.a. target at different points in time and it would be naive to assume that a target like this will be achieved 100% of the time. However, we know that on average the target has been achievable. Consider the chart below, which also goes all the way back to the beginning of last century, and shows the rolling three year returns of this very same generic low equity fund against inflation + 4%:

Source: Nedgroup Investments, Firer Database, Morningstar

As can be seen from the graph above, it is only natural for a low equity fund to experience periods of out- or under-performance of inflation + 4% over rolling three year periods. This has happened many times in the past and is sure to occur again in the future. For those who are interested, the generic fund only outperformed this benchmark 45% of the time, but when it did outperform on average it produced relatively good returns – hence the resultant on-par cumulative returns over the entire period as mentioned above.

Therefore, it is also important to avoid disinvesting after a period of poor performance because you could miss out on periods of subsequent outperformance. Furthermore, there are additional benefits of investing in the Nedgroup Investments Stable Fund beyond those demonstrated with the generic fund shown above. A brief selection of these advantages is listed below:

- Focus on capital preservation

- Tactical asset allocation

- Active stock-picking

- Fundamental equity research

- Duration and credit management (yield curve shifts, active trading when required, etc.)

- Broader diversification (including investing in listed property, commodities, and so on)

- Exposure to offshore (all major asset classes)

This leads to a far smoother return profile and more consistent outperformance of inflation + 4% p.a.

For a better experience of the Nedgroup Investments website, please try the latest version of these browsers