The Stable Fund Series: article 4 of 5: Great risk-adjusted returns

Related links

No related links

Investors should rightfully pay attention to the numerous potential risks before they consider an investment. We consider one of the biggest risks to be permanent impairment of capital – or put more simply we try hard to avoid losing money.

Particularly because the knock-on effect is that outperforming the Fund’s benchmark or even just maintaining the investor’s purchasing power in real terms can become significantly less likely.

It is for this reason that we place a high priority on capital protection when we make investment decisions and when we debate what sufficiently robust portfolio construction to meet this objective actually entails.

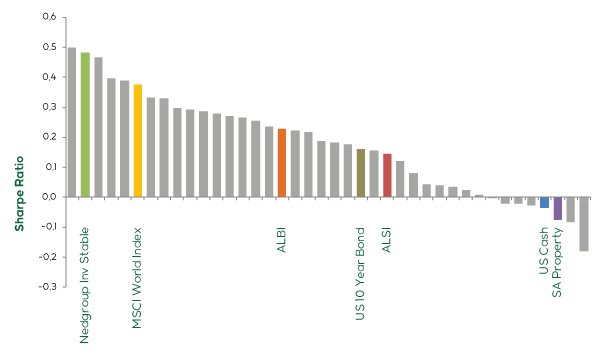

This is evidenced by the Nedgroup Investments Stable Fund’s high Sharpe Ratio (measuring risk-adjusted returns by comparing the Fund’s actual returns to its realised volatility) both within the ASISA low equity category (grey bars shown below) as well as against the underlying asset class building blocks that are used in constructing the portfolio, calculated since launch. Higher Sharpe Ratios describe better risk-adjusted returns:

Source: Nedgroup Investments, Morningstar, data to 31st May 2021

So even though we don’t believe that volatility as a metric can sufficiently quantify all of the risks inherent in investing, we do accept that avoiding permanent losses of capital on a fund level, ceteris paribus, will contribute to lower calculated volatility. As a result, in combination with strong long term returns the Fund therefore has an extremely high Sharpe Ratio as shown in the chart above.

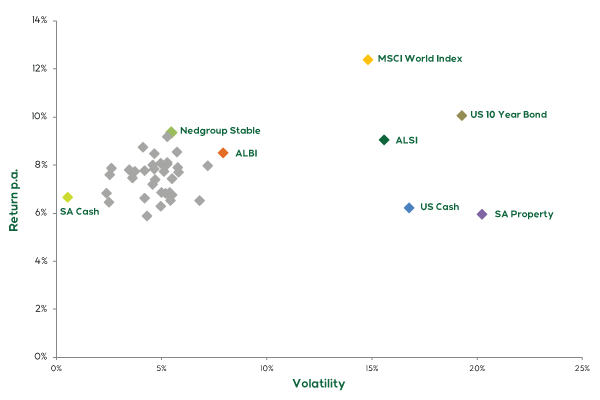

For those who are interested in seeing more of the detail, the chart below shows that the Nedgroup Investments Stable Fund achieved this high Sharpe Ratio by producing the highest returns in the category since launch, while only exhibiting average levels of volatility (category peers are once again shown in grey):

Source: Nedgroup Investments, Morningstar, data to 31st May 2021

An asset class like global equities (in ZAR terms) has performed exceptionally well over this period, but has also been highly volatile which has consequently hurt its risk-adjusted returns.

Before concluding this piece, we thought to share with you that we recently made a short video which showcases the Nedgroup Investments Stable Fund in quite a unique way. If you have not seen it yet, you can enjoy the video using the link below:

https://youtu.be/E_4h045SrH4

We believe that the prospects for the Nedgroup Investments Stable Fund continue to be bright despite the difficult investment environment that we’re faced with. We have full confidence that our strong fundamental research and portfolio construction process holds the Fund in good stead for our investors.

For a better experience of the Nedgroup Investments website, please try the latest version of these browsers