The Stable Fund Series: article 5 of 5: Decisions based on recent performance

Related links

No related links

In our first article, we highlighted the potential impact of shock events and why asset managers must put measures in place that will enable them to operate in an uncertain future environment.

On a daily basis, asset managers have to interpret the information available to them, make judgements and then position their portfolios accordingly. This is certainly no easy task: mistakes can and do happen no matter how good you are.

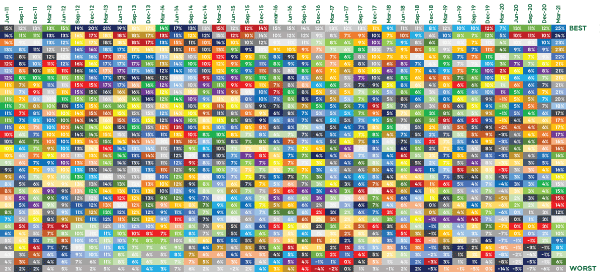

Asset managers use many years of cumulative expertise and research to make rational investment decisions that are not driven by emotion or speculation. Unfortunately for investors though, trying to predict a future winner based on past performance would be much like trying to find a clear pattern in the image below:

Source: Nedgroup Investments, Morningstar, data to 31st March 2021

Much like those old 3D pictures that were quite popular at one point, some may try to see a hidden pattern emerge. However, the reality is that there isn’t one. In fact, each of the hundreds of little blocks in the image above represents a unit trust fund in the low equity category. The funds have been colour coded and ranked according to their one-year rolling returns from best to worst (top to bottom in each column).

We created this chart to illustrate how unlikely it would be to correctly and consistently find a pattern of performance over successive short-term periods.

However, the human mind is a pattern-seeking device, so it is natural that people will still try to figure out if there is any discernible relationship that exists within the data. And while occasionally this may turn out to be the case, one can see from the above diagram that it is more likely to be otherwise.

That is why we believe that it makes far more sense to perform fund selection by using proven qualitative measures (to stack the odds in your favour), and where the strong characteristics of an asset manager in this regard will likely lead to their outperformance over longer periods of time.

Let’s use Foord Asset Management as an example to demonstrate the characteristics that we at Nedgroup Investments look for when selecting an asset manager:

- Managers who own a reasonable stake in the business

- Co-investment alongside clients and alignment of interests

- Valuation driven

- Focus on capital preservation

- Stewardship culture

- Willing to close funds when necessary to protect alpha generation capability

Having these characteristics don’t guarantee that an asset manager will be successful, but research does show that these factors tend to characterise managers who have generated good returns for clients over the long term. It will serve investors well to dedicate a sufficient amount of time to researching which manager to invest with before taking any action. It is all too easy to make a quick decision based on recent short-term performance, which you then regret soon enough!

Remember, even the best investment managers will go through shorter-term periods of underperformance and it will be well worth your while to determine whether the factors causing this underperformance are of a temporary or permanent nature before making any investment decisions in this regard.

In conclusion, despite short term volatility in category rankings, the best will eventually rise to the top over the long term. It is therefore not surprising that the Nedgroup Investments Stable Fund has performed so well within its category since launch measured both on straight performance as well as risk-adjusted returns.

For a better experience of the Nedgroup Investments website, please try the latest version of these browsers