Navigating Global Markets – A Planner’s Guide to Balanced Global Allocation

Related links

No related links

In today’s unpredictable investment landscape, South African financial planners are tasked with guiding clients through a maze of market volatility, currency swings, and geopolitical shifts. The question isn’t just “where to invest,” but “how much global exposure is enough?”

This article builds on our previous piece about retirees and turns the spotlight to lump sum and debit order investors - those saving for education, long-term goals, or generational wealth. When it comes to the question about global exposure, the answer lies in a balanced global allocation strategy that protects purchasing power while embracing growth.

Why Balance Beats Extremes

Let’s start with a story.

Two families invest R100 000 for their daughters’ future university fees. Jane’s parents go fully global. Yanga’s parents choose a balanced approach - 60% global, 40% local.

Twenty years later, despite tough markets, Yanga’s investment has nearly doubled in real terms. Jane’s? Lost purchasing power.

Purchasing power of R100 000 after 20 years in a balanced fund

Source: Nedgroup Investments and the Big Picture App using fees of 0.5% pa with assets invested in 72% equity, 21% bond and 7% using various global allocations

Currency Risk: The Hidden Trap

South Africa’s share of global GDP is tiny, but going all-in globally isn’t always wise. Currency swings can erode returns - even over long periods.

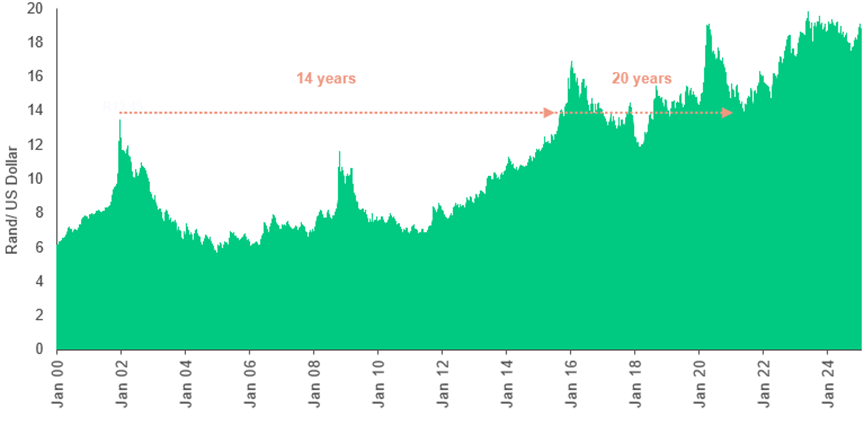

After 9/11, the Rand strengthened dramatically from R13.45 to the US Dollar. It took 14 years to return to its previous level. Only to have it return back to R13.45 again, 20 years after 9/11. That’s a long time for an investor to wait.

Rand / US Dollar Exchange Rate

Source: Nedgroup Investments and Investing.com

Research-Backed Guardrails

Our Nedgroup Investments Core (rules-based) team ran over 1 000 scenarios using the Big Picture App*, which is now free for financial planners through Nedgroup Investments. We tested portfolios with 72% equity, 21% bonds, and 7% cash—typical of a balanced fund.

We looked at:

- Client’s investing for 5 years and longer

- Lump sum investments

- Regular contributions (debit orders)

- Market cycles, currency shifts, and economic shocks

The goal? To find the sweet spot for global allocation.

Case Studies: Lump Sum Investors

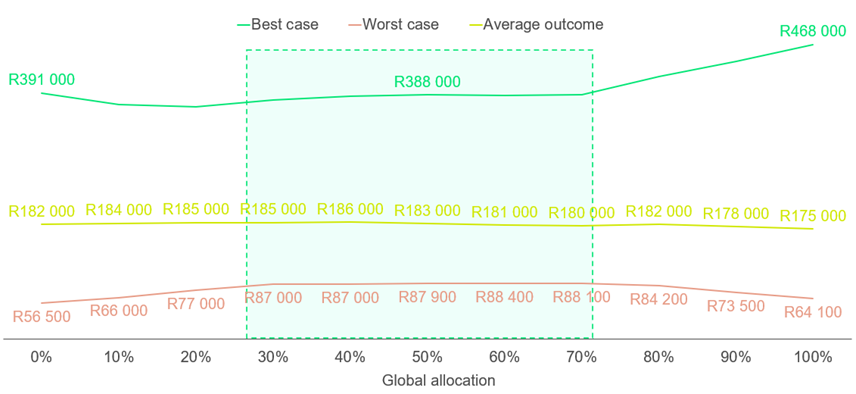

Leonard, a 10-year investor, sees similar average outcomes across all global allocations (yellow line in chart below). But in the worst-case scenarios, extreme allocations (very little or too much global) perform poorly. A 30% to 70% global allocation is optimal as it offers better downside protection.

Purchasing power of R100 000 invested for 10 years in a balanced fund

Source: Nedgroup Investments and the Big Picture App using fees of 0.5% pa with assets invested in 72% equity, 21% bond and 7% using various global allocations

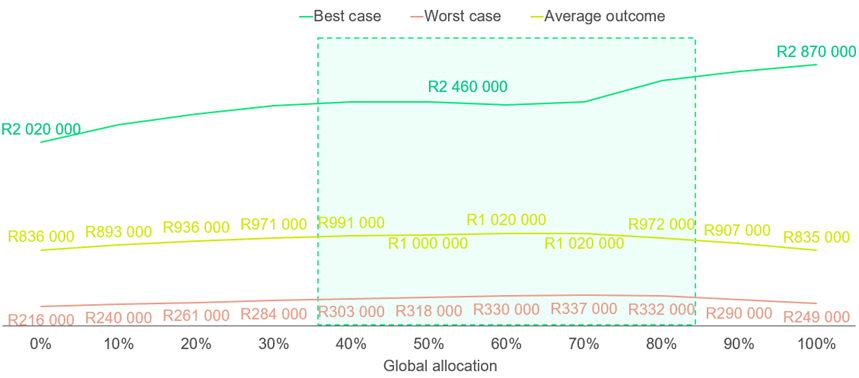

His brother, investing for 40 years, sees more variation in average outcomes. Again, extremes underperform. Surprisingly, the optimal range only shifts slightly to 40% to 80%, despite the notable increase in time horizon.

Purchasing power of R100 000 invested for 40 years in a balanced fund

Source: Nedgroup Investments and the Big Picture App using fees of 0.5% pa with assets invested in 72% equity, 21% bond and 7% using various global allocations

Debit Order Investors

The research found that the optimal global allocation range for debit order investors is surprisingly similar to that for lump sum investors.

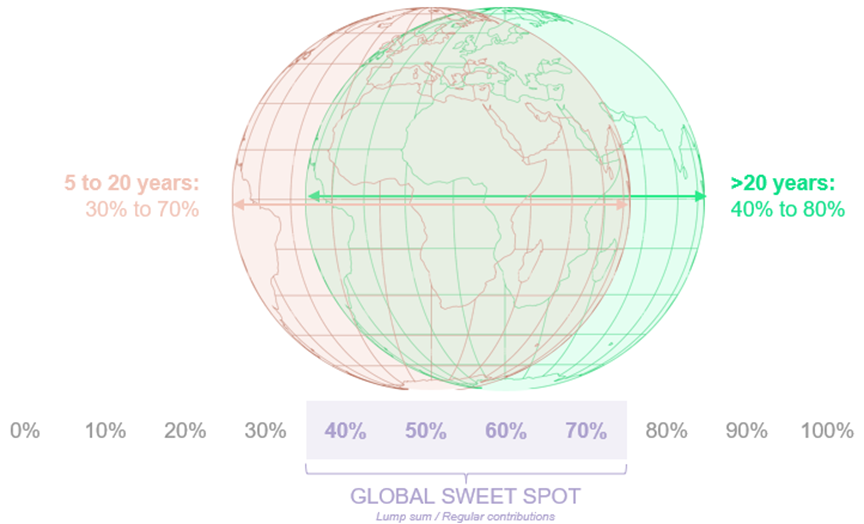

Practical Framework for Planners

These are just two lump sum case studies from our research. Here’s what the research tells us. The optimal global allocation for both lump sum investments and regular contributions by investment horizon is:

- 5 to 20 years: 30–70%

- 20+ years: 40–80%

The universal sweet spot is 40–70%.

Source: Nedgroup Investments

This research and these ranges are already embedded in the Nedgroup Investments Core Multi-Asset range:

- Core Diversified: 40% global

- Core Accelerated: 45% global

Both comply with Regulation 28 and are designed to meet real-world planning needs.

Why This Matters

In contrast to conventional portfolio construction methods that prioritise short-term relative valuations and market dynamics, our strategy is founded on established financial planning principles. This approach is designed to:

- Deliver optimal results for clients

- Instill confidence in clients as they navigate their financial goals

Let’s Talk

Want to explore how global allocation can elevate your clients’ portfolios? Reach out to your Nedgroup Investments relationship manager. We’re here to help you navigate the complexities and deliver outcomes that matter.