Why I'm buying Japanese Government Bonds

Related links

No related links

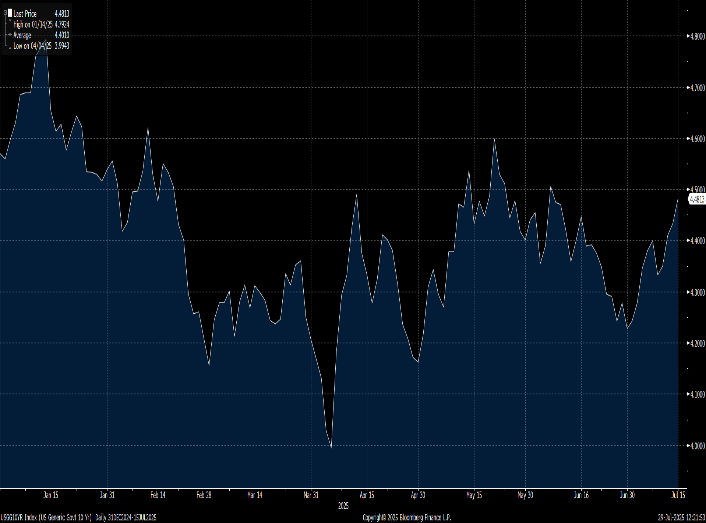

There is a perception that bond markets have been more volatile in recent times than they were say a decade ago. Whether that perception matches reality or not depends on your time frame. And which part of the bond market you have been looking at.

By mid July, the bell weather US ten year Treasury bond price was little changed year to date – yields falling around 0.1%. However over shorter time periods, week to week or even intra day, prices and yields have often moved significantly more.

Source: Bloomberg

Source: Bloomberg

We have long argued that whilst politics can move markets in the short term, over longer time frames the bond market responds more to fundamental economics. To that extent, the outlook for G7 inflation and growth is little changed compared with January 1st. Tariffs will take their toll. However the underlying global economy is proving more robust than many commentators expected, in part cancelling out US growth destructive policy.

Many of those shorter term bond moves appear to have been “headline induced” – markets reacting to shock and awe news, before reverting toward prior levels. Much has been made of the “TACO” trade. I’d suggest market reversion owes as much to ongoing assessment of value and fundamentals as it does to second guessing the US President. Either way, the volatility is great for active investors

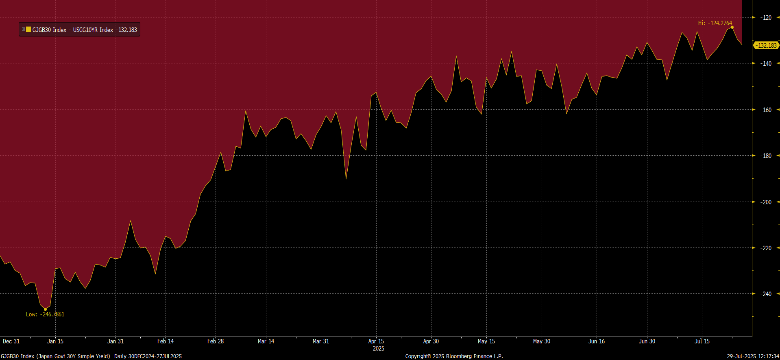

One place where we have seen market dislocation and no reversion is with long maturity Japanese Government Bonds. 30 year yields increased to over 3%, a level never seen this century!

Why?

As the chart below shows, yields have been rising steadily all year, albeit with material spikes in both directions. Economic data has been stronger than expected, inflation into its third year of exceeding the Bank of Japan’s target.

Source: Bloomberg

Having calmed down for most of May and June, the market once more became volatile. Chat that inflation would accelerate, the ruling party lose their upper house majority and fiscal spending increase all proved correct. That chat morphed into bond negative headlines across global news services.

Indeed by mid July, you’d have been forgiven for thinking Japan was about to experience its own Liz Truss moment. Commentators picked up all the above points and talked about a “buyers strike”. By late July, the ruling coalition had lost their majority. A trade deal had been struck with the US. Inflation remained well above target. Yet long dated yields were actually FALLING.

Better to travel than arrive?

Were these market moves signs of an efficient market, pricing correctly for high probability events? Or perhaps symptomatic of investor panic, creating an oversold situation. Either way, analysis suggested opportunity in BUYING long maturity bonds.

1. Value: as noted above, it is 3 DECADES since 30year JGB yields were so high. The “curve” (difference between cash rates and 30 year) was incredibly steep meaning buying the bonds and transferring the income to UK or US gave a yield of over 7% - where similar domestic bonds paid 4-5%. And last but not least the Relative Value to other markets greatly improved: in January we were “paid” 2.5% LESS to own Japan than the US. That had reduced to 1.24% by mid July.

Source: Bloomberg

2. Fundamental economics: The Bank of Japan is “behind the curve” hoping for inflation to cool. With the tariff threat receding and CPI still around 3% it is highly likely they raise rates by year end – that SHOULD be a good thing for long maturity bonds, reducing inflation in years to come

3. Technicals: there has been no buyers strike. Indeed evidence suggests international investors are turning their attention to Japan – I bought long maturity JGBs for the first time in my THIRTY odd years career. And although supply will increase, the amounts seem both known and manageable.

There is an old investment maxim: By the time everyone is talking about it, it’s in the price.

Japanese bonds don’t tend to get much attention in the UK or Europe. Yet they represent around 15% by duration of the Global Bond index – nearly TRIPLE the weight of sterling denominated debt. The fall in price (or rise in value) we have seen year to date was enough to make headlines in London and Frankfurt – the move seen as a lesson for other indebted G7 nations?

Many who don’t follow the market could have been forgiven for thinking the JGB market was an accident waiting to happen.

Source: Bloomberg

Reality is, the accident has been happening for at least 5 years. 30 year JGBs are now valued at only 54% of their 2020 price.

Back in 2020 when many bonds were offering zero or even negative yields, investors were still being advised to “pile in”. That proved the moment to sell. Many subsequently lost money as yields normalised, moving back to today’s much more attractive, inflation beating levels.

International investors, myself included have long avoided heavy exposure to the Japanese bond market. The price of long bonds has almost halved in 5 years. Indeed they are down nearly 20% year to date, in sharp contrast to stability in other bond markets.

That relative value, that 7% yield when switched to Sterling or US Dollars, looks a lot more like opportunity than threat. After thirty years of avoiding them, now seems the right moment for me to buy.

Disclaimer

This article is of a general nature and intended for information purposes only, it is not intended for distribution to any person or entity who is a citizen or resident of any country or other jurisdiction where such distribution, publication or use would be contrary to law or regulation. Whilst all reasonable steps have been taken to ensure that this article is accurate and current at the time of publication, we shall accept no responsibility or liability for any inaccuracies, errors or omissions relating to the information and topics covered in this article.

The opinions expressed within the article are considered to be correct and informed at the time of writing, but may be subject to change or amendment at the discretion of the Investment Manager without notice.

Nedgroup Investment (IOM) Limited (reg no 57917C), is licensed by the Isle of Man Financial Services Authority.

Nedgroup Investments (UK) Limited is regulated by the Financial Conduct Authority.