The 6 South African investor archetypes according to Nedgroup Investments study

Related links

No related linksArticle highlights

- With this study, we have the opportunity to use the same level of sophistication to help investors make better decisions

- The six investing personalities identified occur in all ages, and both genders

In a behavioural study that surveyed over 3 000 South African investors and financial planners, Nedgroup Investments has identified 6 investment personality archetypes that could give investors and advisors brand new insight into how they can make better investment decisions.

Amy Jansen, Head of Behavioural Solutions at Nedgroup Investments, says the study is part of a drive by the asset manager to foster better informed and more empowered investors in South Africa.

“The investment industry has long used sophisticated techniques for building investment portfolios. Now, with this study, we have the opportunity to use the same level of sophistication to helping investors make better decisions as they travel their investment journeys,” she says.

Jansen says that by looking beyond demographics and delving into the psychological variables for each individual investor, it’s possible to create investment journeys that have the best possible chance of ensuring investors arrive at their investment goal.

The study, in partnership with Oxford Risk assessed 12 personality traits across a variety of clients and identified six main personality archetypes. The South African study revealed some very interesting differences between our sample and the baseline studies which identified these traits:

• South African investors in this sample show a stronger link between low composure and high desire for guidance. This means that more nervous respondents tended in our study to have a higher desire for professional help with their investments when compared to the more nervous investors of other studies.

• A stronger link between impact desire and impact trade-off. The desire for investments to do social good, and a willingness to make sacrifices in order to achieve this good, were more closely correlated in our study compared with other surveyed populations.

• Higher scores on Comparison Tendency. The tendency for investors to compare investment returns with how the market, and others, have done, rather than just focusing on their own returns is significantly higher in this sample than in the UK baseline.

• Higher scores on Internal Locus of Control. The belief in skill and hard work, rather than luck as determinants of investment success is significantly higher in this sample than in the UK baseline.

Interestingly, when we investigate the demographics, we see that overall, the six investing personalities identified occur in all ages, and both genders.

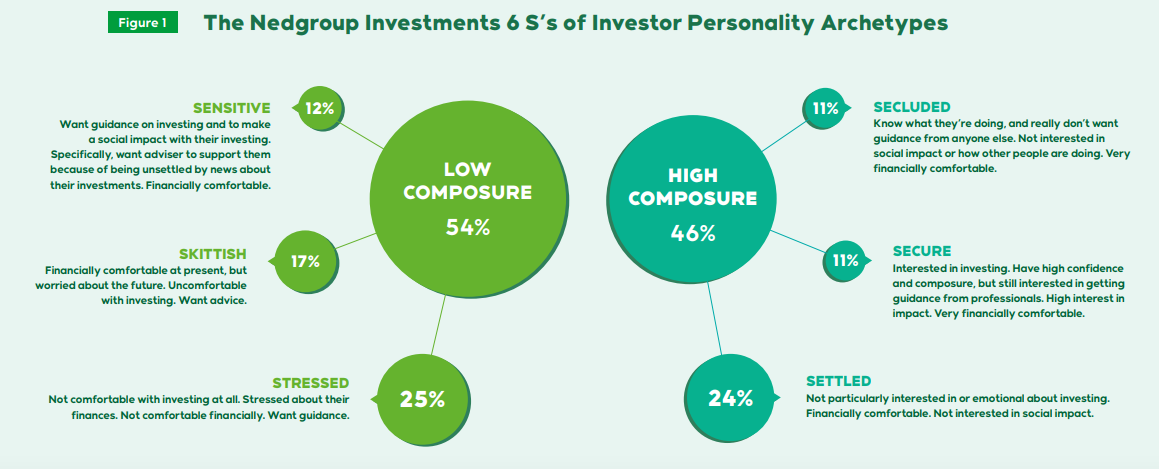

The Nedgroup Investments 6 S’s of Investor Personality Archetypes

The low composure groups

The ‘low composure groups’ as identified by the study are groups that are easily affected by short-term? news about their investments. They also tend to want more guidance from professionals.

Within this, there is the ‘Stressed’ group who seem to be generally uncomfortable with investing – low composure, low confidence, and low financial comfort. This group would likely appreciate things being slowed down, spelled out, and simplified for them.

The ‘Sensitive’ group have the highest impact trade-off and impact desire, as well as the highest desire for guidance and locus of control. This indicates that they are interested in doing social good with their investments and would appreciate active professional help to do so.

Meanwhile, the ‘Skittish’ group had the strongest response to questions indicating that although they are financially comfortable now, they fear a future event where they may need to draw down on their investments for income.

The high composure groups

The high composure groups are groups which are typically less unsettled by news that could affect their investments. They also have a more muted desire for guidance.

The ‘Secluded’ group have particularly high composure and the lowest desire for guidance, which indicates that essentially, this group is more than happy to look after themselves.

Meanwhile, as the name suggests, the ‘Secure’ group displayed a much more muted desire for guidance tendency far more muted preference. Interestingly this group also displayed a high interest in impact.

“Understanding the influence of personality on behaviour allows us to identify what could derail each investor’s investment journey. Harnessing this insight, we can create the infrastructure to support those journeys that increases the likelihood that investors make choices through the journey that match their investment goal.,” says Jansen.

Click here to see the full Nedgroup Investments Investor Personality Report 2021

For a better experience of the Nedgroup Investments website, please try the latest version of these browsers

%20-%20Website%20Images%20(1400x900)Adjusted.jpg)