Opportunity Fund

The Nedgroup Investments Opportunity Fund is a multi-asset fund that diversifies across asset classes both locally and offshore. The fund's maximum equity exposure of 60% helps to reduce risk and volatility relative to an average prudential portfolio.

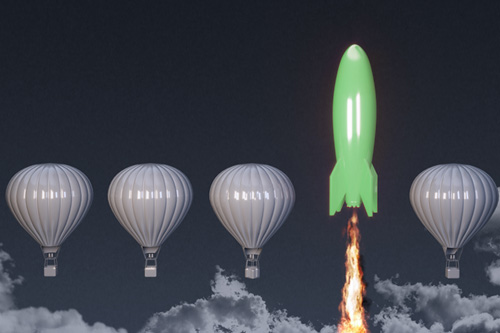

Reasons to invest

Balancing risk across the alpha sources positions the fund to be robust in a range of market outcomes and deliver diversified sources of returns | Focus on quality and price paid to protect the downside while capturing as much upside as possible | Managed by a stable and experienced team with depth and breadth of experience across equity, fixed income, alternatives and asset allocation, both locally and abroad

Specific fund risks

Equity and property investments are volatile by nature and subject to potential capital loss | Fixed income instruments, including corporate and government bonds, may experience capital loss in the event that an issuer defaults on their interest or principal payments | The portfolio may be subject to currency fluctuations due to its international exposure

Suitable for

The Opportunity Fund is suitable for investors looking to grow their capital in excess of inflation over the long-term but require some level of capital protection over rolling 2-year periods. Investors who do not wish to make complex asset allocation decisions between equities, property, cash, bonds and alternative assets, both locally and offshore, may invest in this fund