Savvy savings: Celebrating a decade of tax-free investing in South Africa

%20-%20Website%20Images%20(1400x900)Adjusted.jpg)

Related links

Listen to our podcast on tax-free investing

As we approach the ten-year milestone of Tax-Free Investment accounts (TFIs) in South Africa, it's a perfect time to reflect on the remarkable benefits these accounts have brought to diligent savers. This article will explore the journey of TFIs, their advantages, and how you can maximise your savings with the guidance of Nedbank Financial Planners.

The power of compounding: A success story

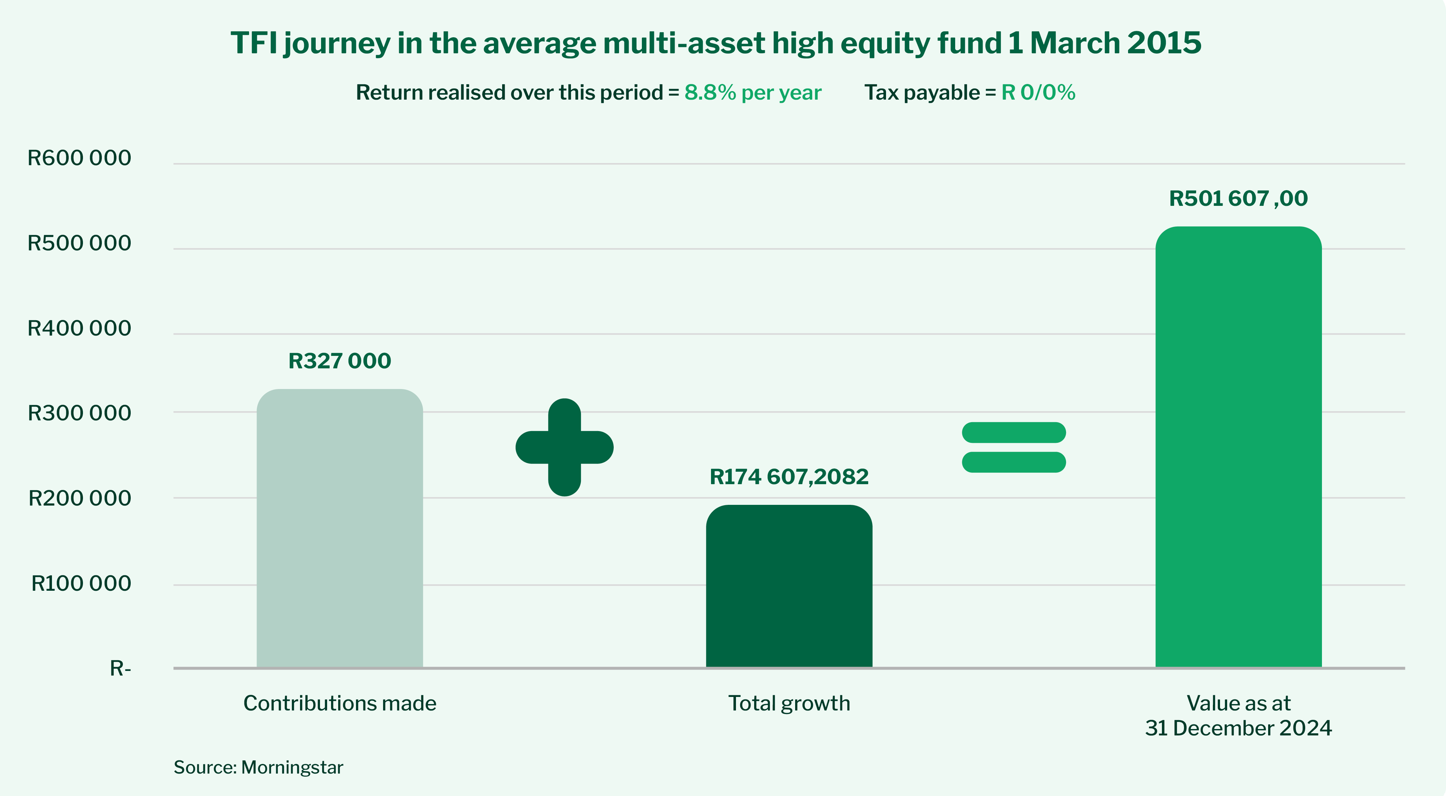

One of the most compelling benefits of TFIs is their long-term nature combined with the power of compounding, often referred to as the eighth wonder of the world. Investors who have consistently maximised their monthly contributions since the beginning now have close to or, in many cases, more than R500 000 saved, depending on their fund choice.

Source: Morningstar

The graph above shows the performance of an investor who picked an average fund in the ASISA multi-asset high equity category. This category includes balanced funds with up to 75% in stocks or equity exposure and up to 45% in offshore exposure. The investor also made the maximum monthly contributions allowed since the beginning.

At Nedgroup Investment, we're proud to manage R1.1 billion in Tax-Free Investment accounts (TFI) for 9 200 clients. On average, each client has around R120 000 in their TFI, with some clients already exceeding R600 000. It's also noteworthy that 60% of our annual contributions come from existing clients topping up and only 40% from new TFI accounts being opened. Many of our clients who have unit trust or retirement product investments with us, still have the opportunity to benefit from the amazing advantages of our TFI.

So, what exactly is a Tax-Free Investment Account?

Tax-Free Investment accounts offer South African taxpayers a unique opportunity to grow their savings without the burden of taxes on interest, dividends, or capital gains. This means investors will not pay a single cent of tax on their TFIs as long as their savings are within the determined annual and lifetime limits. You can invest up to R36 000 per year in a fund of your choice and a total of R500,000 over your lifetime. While withdrawals are allowed, they cannot be replaced, and any contributions exceeding the annual limit will incur a 40% tax penalty. This structure encourages consistent saving and long-term investment.

Additionally, you may open a TFI account for your child, allowing them to benefit from tax-free growth and the power of compounding from an early age. Your child can access the funds when they turn 18, providing them with a solid financial foundation for their future.

Unlock your full Tax-Free Investment potential

If you have already maximised your annual TFI contributions, you still have R173 000 of your lifetime limit left to invest. This presents a fantastic opportunity to continue your disciplined saving habits and witness the power of tax-free growth. If you started later or have not yet taken full advantage of your TFI allocation, the success stories of diligent savers serve as powerful motivation to get started today.

Take action today

As we gear up to celebrate a decade of Tax-Free Investment accounts, we invite you to join the ranks of successful savers who have harnessed the power of compounding and smart financial planning. Whether you're just beginning your journey or looking to maximise your remaining lifetime limit, be sure to reach out to a Financial Planner to support you every step of the way.

For existing investors: Continue your diligent saving habits and make the most of your remaining lifetime limit. Your future self will thank you.

For new investors: Be inspired by the success stories of others and start investing in a Tax-Free Investment account today. With the guidance of a Financial Planner, you can achieve your financial goals and secure a brighter future.

Start your journey towards financial success today. Let's celebrate this milestone together and look forward to many more decades of smart, tax-free investing.