Stable Fund

The Nedgroup Investments Stable Fund is a Regulation 28 compliant multi-asset class portfolio. The fund diversifies across asset classes both locally and offshore.

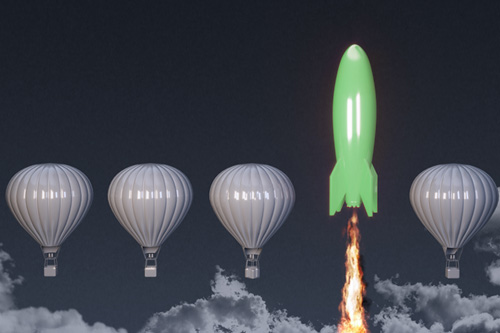

Reasons to invest

Optimally invests in a wide range of asset classes, both local and offshore to diversify the portfolio and smooth returns | Downside protection is of paramount importance when delivering real long-term value for investors | Rigorous investment process combines top down asset allocation along with bottom-up stock selection in portfolio construction and risk management. The portfolio is managed holistically to balance the impact of economic and market risk factors in producing absolute returns

Specific fund risks

Equity and property investments are volatile by nature and subject to potential capital loss | Fixed income instruments, including corporate and government bonds, may experience capital loss in the event that an issuer defaults on their interest or principal payments | The portfolio may be subject to currency fluctuations due to its international exposure

Suitable for

The Stable Fund is suitable for conservative investors requiring a high level of capital protection, with the potential for capital growth. Investors who are looking to draw a regular income with a focus on stability of capital and do not wish to make complex asset allocation decisions between equities, property, cash, bonds and commodities, both locally and offshore, may invest in this fund